Tata Motors EV Shipments Hit Record Levels in October: 9,286 Units, up 73%

Driven by strong Harrier EV demand, Tata Motors’ EV wholesales topped 9,000 units for the second straight month, taking Jan–Oct 2025 dispatches to 66,308 units — 96% of last year’s total. CY2025 EV sales may hit 85,000 units.

The festive month of October turned out to be one of fireworks for Tata Motors. The car and SUV manufacturer reported record monthly wholesales of 61,134 units, up 27% YoY (October 2024: 48,131 units). What also helped drive the strong numbers was the 15% contribution by its electric vehicle portfolio. At 9,286 units, Tata EV wholesales are the highest monthly score for the company and rose 73% YoY (October 2024: 5,355 EVs).

Tata Motors, which has benefited from the recent launch of the Harrier EV and continues to see demand for the Punch and Nexon EVs along with the Curvv EV, is witnessing a revival of demand for its zero-emission cars and SUVs. With October’s record performance, the company’s EV wholesales (read: factory dispatches) have hit record monthly numbers for three months in a row, and surpassed 9,000 units for two straight months.

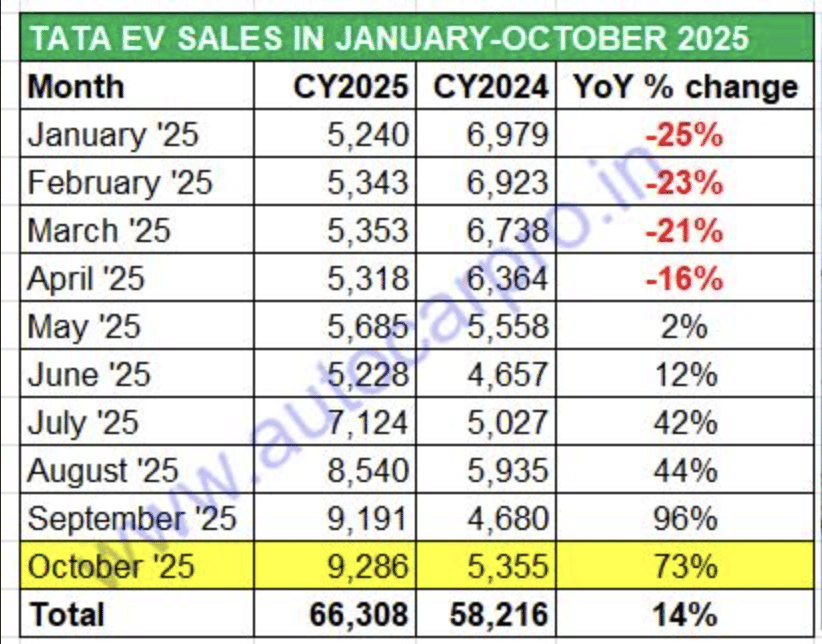

As the 10-month sales data table (below) for the current calendar year shows, total wholesales at 66,308 units are up by 14% YoY (January-October 2024: 58,216 units). This constitutes 96% of Tata Motors’ total EV sales of 68,980 units in CY2024. The company’s best annual sales were in CY2023: 69,153 units. Given the current growth trajectory, expect Tata Motors to wrap up CY2025 with record annual EV sales in the region of 85,000 units.

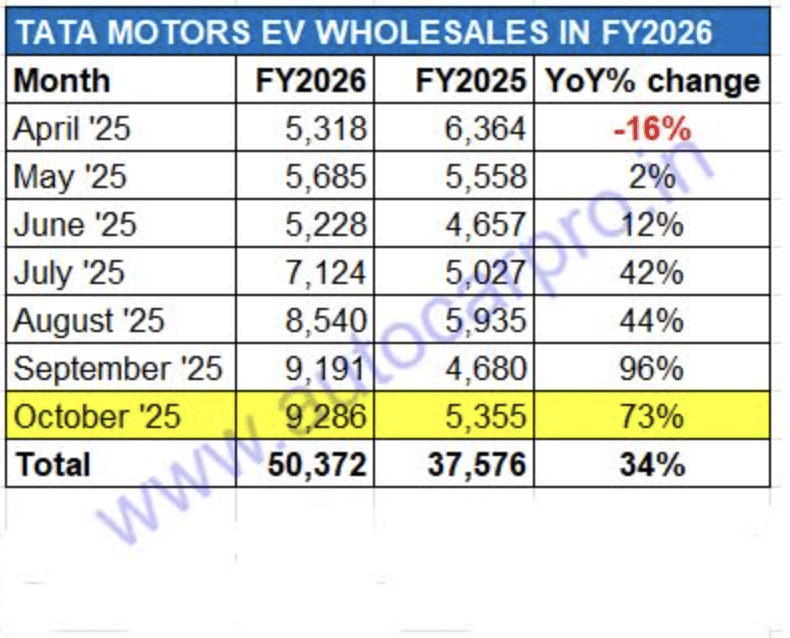

Fiscal-year sales 50,372 e-PVs for the April-October 2025 period reflect higher 34% YoY growth (April-October 2024: 37,576 e-PVs), indicating that Tata Motors will also register a new high in e-PV wholesales for FY2026.

Tata Motors’ EV wholesales surpassed the 9,000 mark for the second straight month in October 2025 which, with 9,286 units, contributed 15% to the company’s record PV dispatches of 61,134 units.

After four months of decline from January to April, sales returned to positive territory from May 2025 onwards. Given Tata Motors’ estimated PV sales of 471,289 units in the January–October 2025 period, the EV penetration level for the first 10 months of CY2025 is 14%, compared with 12% in CY2024.

The marked increase in monthly wholesales from July can be attributed to the launch of the Harrier EV in June. Priced at Rs 21.49 lakh (ex-showroom), the Harrier EV is Tata Motors’ most advanced zero-emission vehicle to date and marks the return of all-wheel drive (AWD) to the brand.

It is India’s first mass-market e-SUV to offer AWD and has a claimed range of over 600km on a single charge. Built on the company’s Acti.ev Gen 2 platform, the Harrier EV is targeted at all SUV buyers, even those who prefer IC-engined models.

Tata Motors, which sells the electric avatars of the Punch, Nexon, Curvv, Tiago, Tigor, and Harrier, has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of which have launched new EVs in the past year and currently (October 2025) have a combined retail market share of 46%, compared with 23% in October 2024.

Looking to regain lost market share

On the retail sales front, Tata Motors sold 7,118 units last month, up 8% YoY (October 2024: 6,608 units) and 7% up month on month (September 2025: 6,634 units). This is its second highest monthly score after August’s 7,503 units and gives it a market-leading share of 40% for October 2025, the same as in September.

Tata Motors’ current retail EV market share is considerably down from the 65% market share it commanded a year ago. The recently launched Harrier EV has helped revive demand even as the Punch, Nexon and Curvv EVs continue to have their fair share of buyers.

Tata Motors, which is taking rearguard action to protect its turf and leadership, plans to regain lost e-PV market share with a goal of holding a 50% share. This strategy is part of a new product offensive that calls for a mega Rs 35,000 crore investment and involves expanding its presence in under-served segments — urban compact EVs, lifestyle SUVs, midsize family cars, and premium electric SUVs — while refreshing its core ICE portfolio.

ALSO READ: Tata Motors maintains 40% share of electric PV market in October

Bajaj Auto Regains E-2W Crown, Industry Clocks 143,000 Units in Record-Breaking October

Ather Energy Clocks Best-Ever Monthly Sales in October: 28,000 Units

Bajaj Auto Regains E-2W Crown, Industry Clocks 143,000 Units in Record-Breaking October

RELATED ARTICLES

TVS Apache Rules 150-200cc Segment, Set for Record Sales of 550,000 in FY2026

With 382,431 units sold in the first 8 months of FY2026 and 24% growth, TVS Motor’s best-selling motorcycle not only com...

Maruti Fronx First Nexa SUV to Drive Past 400,000 Sales

Maruti Suzuki’s Fronx has crossed 400,000 domestic wholesales in 32 months and leads Nexa’s FY2026 lineup with 108,866 u...

River Mobility Clocks Best-Ever Monthly Sales in November: 1,801 Indie E-Scooters

Bengaluru’s River Mobility, maker of the Indie e-scooter that inspired Yamaha’s EC-06, crosses 1,800 monthly sales and 1...

By Ajit Dalvi

By Ajit Dalvi

03 Nov 2025

03 Nov 2025

11532 Views

11532 Views