Indian EV Makers Sell Record 234,000 Units in October, Charge Towards 2 Million in CY2025

Riding on best-ever monthly sales of the 2W and 3W segments and strong growth for passenger and commercial vehicles, India’s EV industry scales a new high. With 1.84 million units sold between January and October, the 2-million milestone will be crossed very soon for the first time in a calendar year.

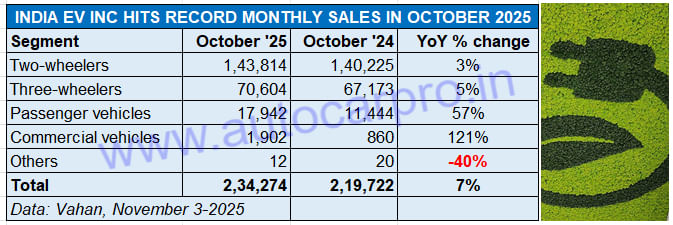

The Indian EV industry, whose GST rate of 5% was left untouched as compared to its fossil-fueled brethren which benefited from a substantial reduction, is on a roll this year. Retail sales this October at a record 234,274 units, up 7% YoY and an additional 14,552 units (October 2024: 219,722 units) have breezed past the previous monthly best of 219,722 EVs exactly a year ago. This new monthly benchmark translates into 7,557 EVs sold on each day of October 2025.

Importantly, what augurs well for the overall EV industry is that all four vehicle segments – two- and three-wheelers, passenger and commercial vehicles – have registered year-on-year growth (see October 2025 retail sales data table below). While e-2Ws, which represent the largest volume segment and have a 61% share of the EV market, posted 3% growth, the e-3W category saw 5% YoY growth and accounted for a 30% share of EV sales across segments. Zero-emission passenger vehicle sales rose strongly by 57% as did e-CVs, by 121% on a low year-ago base.

All four sub-segments of the EV industry registered YoY growth and contributed to October 2025 being the month with the best retail sales yet: 234,274 units.

Electric 2-wheelers: 143,814 units, up 3% YoY

Share of India EV market: 61%

The electric two-wheeler segment, which comprises scooters, motorcycles and also mopeds and accounts for the largest share of EV sales, is driving the charge for India EV Inc. In October, this sub-segment registered its best-ever monthly numbers – 143,814 units. This makes for 3% YoY growth on a large year-ago base (October 2024: 140,225 units). October 2025’s record sales beat the previous monthly best – March 2024 (140,350 units) and October 2024 (140,225 units). These three months are the only ones when India e-2W Inc has surpassed 140,000 retail sales.

What’s more, as a result of seven-figure sales for six months running, cumulative January-October 2025 sales have crossed the million-units mark for the first time in the first 10 months. At 1.06 million units and 11% YoY growth, the electric 2W industry is only 85,950 units away from riding past its best-ever annual sales of 1.14 million units it clocked in CY2024. This milestone will be achieved in November 2025 itself, which means the e-2W industry could well be looking at a new sales high of 1.25 million units in CY2025.

In October, combined sales of the top six OEMs – Bajaj Auto, TVS Motor Co, Ather Energy, Hero MotoCorp, Ola Electric and Greaves Electric Mobility accounted for 89% of the total e-2W sales across India (barring Telangana for which Vahan data is not available), leaving the balance 10% to be fought over by 190 other e-2W players. CLICK TO READ October sales analysis, a month when Bajaj Auto regained the e-2W crown after 6 months, wresting it from TVS Motor Co.

Electric 3-wheelers: 70,604 units, up 5% YoY

Share of India EV market: 30%

The electric three-wheeler segment too is in good nick. In tandem with the electric 2-wheeler industry, which notched its best-ever monthly sales in October 2025, the second largest contributor to India EV Inc too had a good outing last month. The electric 3-wheeler industry hit a new monthly retail sales high of 70,604 units, up 5% YoY (October 2024: 67,173 units) and crossed the 70,000-unit mark for the first time, beating the previous best of 69,125 units in July 2025.

The electric 3W industry, which is the one witnessing the fastest transition from ICE to e-mobility, is well set to register its best-ever annual sales this year. With two months left to go in CY2025, the e-3W industry is well set to achieve its best-ever calendar-year sales. As per retail sales statistics on the Vahan portal, a total of 625,866 units were delivered between January and October, up 10% YoY (January-October 2024: 568,478 units). This translates into 90% of its record full-year CY2024 volume of 691,302 units. E3W makers need to sell 65,437 units more to cross the CY2024 total and if the current growth trajectory is sustained, this segment of the EV industry is likely to surpass the 700,000-unit milestone this month (November 2025). With December to follow, India e-3W Inc could be looking at a new annual retail sales record of 750,000 units and 8.5% YoY growth on a high year-ago base.

This segment is dominated by a select few OEMs – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, TVS Motor Co, Saera Electric Auto, Dilli Electric Auto, Piaggio Vehicles, Mini Metro and Energy EV. However, the real battle is being fought at the podium level between Mahindra Last Mile Mobility, Bajaj Auto, YC Electric and recent entrant TVS Motor. CLICK TO READ the e-3W October sales analysis, a month when Mahindra, Bajaj Auto and TVS Motor have each achieved their highest monthly retail sales.

Electric passenger vehicles: 17,942 unit, up 57% YoY

Share of India EV market: 8%

The next biggest contributor to India EV Inc sales is the electric passenger vehicle segment with an 8% share in October 2025. Even as the overall passenger vehicle market saw record wholesales of over 500,000 units in the festive month of October 2025, retail sales of electric PVs recovered last month after witnessing a month-on-month fall in September (16,354 units). October saw 17,942 zero emission cars, SUVs and MPVs being delivered across India, marking a 57% YoY increase (October 2024: 11,444 units) and 9% MoM growth.

October 2025 marked the second-highest month for e-PV sales after August 2025 and saw both market leader Tata Motors, which maintains its 40% share, and Mahindra & Mahindra register their highest monthly retail sales yet. While No. 2-ranked JSW MG Motor India sold 4,497 units, Kia India, riding on strong demand for the Carens Clavis EV, clocked sales of 655 EVs to go ahead of BYD and Hyundai Motor India.

October was the second month of sales for the two new EV manufacturers in India – Tesla and VinFast – who have joined the existing 14 players in the e-PV market. CLICK TO READ the e-PV October sales analysis.

Electric commercial vehicles: 1,902 units, up 121%

Share of EV industry: 1%

The electric commercial vehicle segment has seen demand jump 121% YoY to 1,902 units (October 2024: 960 e-CVs). The light goods vehicles sub-segment, with 1,497 units and a 79% share of e-CV sales, has registered strong 239% YoY growth on a low year-ago base (October 2024: 441 units), reflective of the growing demand for emission-free last mile mobility in the country, particularly in urban India. Electric passenger bus OEMs, most of whom bank on business from State Transport Undertakings, sold 290 units in October and posted a 28% YoY decline (October 2024: 404 e-buses).

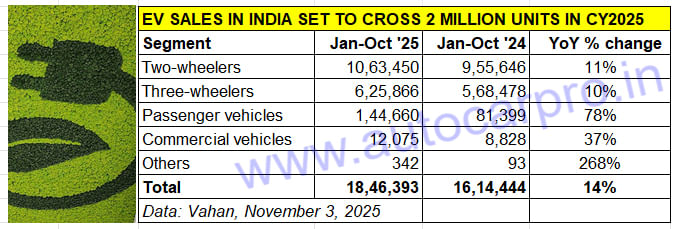

EV makers need to sell another 153,608 units to surpass the 2-million milestone, which should be achieved in November 2025. Expect total CY2025 sales to be in the region of 2.15 million units.

INDIA EV INC TO SOON CHARGE PAST 2 MILLION SALES THIS YEAR

Having missed the 2-million retail sales milestone in in calendar year 2024 by a whisker, India EV Inc is well set to surpass the big 20,00,000 number in CY2025. In the first 10 months of the current calendar year (January-October 2025), as per sales data on the Vahan portal, a total of 18,46,393 EVs has been delivered to customers across segments. This is a YoY increase of 14% and translates into an additional 231,949 units. It also means EV makers will have to sell another 153,607 units to attain the 2-million retail sales milestone for the first time in a calendar year. This is a new retail sales milestone which the EV industry will achieve in November 2025 itself.

What is noteworthy is that the record-breaking October 2025 was the first month after GST 2.0, which helped reduce prices of IC engine vehicles, made them more affordable and also shrunk the gap between them and electric vehicles. Nevertheless, last month’s stellar EV market performance proves that the zero-emission EV industry has little to fear about sales being eaten into by its fossil-fuelled brethren.

After the first 10 months of this year, all four EV segments are set to charge past their CY2024 sales total, and thereby enable India EV Inc to set a new annual retail sales benchmark. With November and December numbers yet to be counted, expect CY2025 to turn in total sales in the region of 2.15 million units. Stay plugged into Autocar Professional, as we bring you the latest and accurate sales numbers and analyses of the domestic EV industry.

RELATED ARTICLES

TVS Apache Rules 150-200cc Segment, Set for Record Sales of 550,000 in FY2026

With 382,431 units sold in the first 8 months of FY2026 and 24% growth, TVS Motor’s best-selling motorcycle not only com...

Maruti Fronx First Nexa SUV to Drive Past 400,000 Sales

Maruti Suzuki’s Fronx has crossed 400,000 domestic wholesales in 32 months and leads Nexa’s FY2026 lineup with 108,866 u...

River Mobility Clocks Best-Ever Monthly Sales in November: 1,801 Indie E-Scooters

Bengaluru’s River Mobility, maker of the Indie e-scooter that inspired Yamaha’s EC-06, crosses 1,800 monthly sales and 1...

By Ajit Dalvi

By Ajit Dalvi

05 Nov 2025

05 Nov 2025

5839 Views

5839 Views