Tata Motors Posts Record PV Sales in September 2025

Tata Motors has achieved one of its highest-ever monthly passenger vehicle sales in September 2025, delivering 60,907 units (including 59,667 domestic units) - a remarkable 47% year-on-year surge.

A month after reporting soft wholesale numbers, Tata Motors has achieved its highest-ever monthly passenger vehicle shipments in September 2025, delivering 60,907 units (including 59,667 domestic units) - a 47% year-on-year surge. The milestone comes as the Indian automotive industry experiences a dramatic reversal from August's GST-induced paralysis to September's renewed enthusiasm. The trend is also visible in retail sales, as reflected in Vahan data.

Soon after GST 2.0 came into effect, Tata Motors recorded sales of nearly 10,000 passenger vehicles in a single day, supported by over 25,000 customer enquiries at its dealerships nationwide. GST reforms had reduced tax rates on small cars from 28% to 18%, effective from September 22, 2025.

In contrast, Tata's passenger vehicles division had slipped 7% year-on-year to 41,001 units in August, as widespread speculation about the GST cuts led prospective buyers to delay their purchases and dealers to cut back on stocking vehicles. Sales had slumped as speculation mounted that a mid-size SUV priced at ₹15 lakh could see potential savings of approximately ₹1.5 lakh under the new tax regime.

Tata vs Mahindra

While Tata Motors celebrated its overall monthly record, arch-rival Mahindra & Mahindra wasn't far behind with its own impressive milestones. Mahindra reported its highest-ever monthly domestic SUV sales of 56,233 units in September 2025, marking a 10% year-on-year growth, with total vehicle sales (including three wheelers and exports) crossing the psychological 100,000-unit mark at 100,298 vehicles - a 16% increase over September 2024.

The comparison is particularly interesting given both companies' different strategies heading into September. While Tata saw its August sales drop by 7%, Mahindra experienced a steeper 9% decline to just 39,399 SUVs in August. Mahindra CEO Nalinikanth Gollagunta had explicitly stated that the company "consciously decided to bring down the wholesale billing to minimize the stock being carried by our dealers" - a more conservative approach that protected dealer margins but sacrificed August volumes.

However, Mahindra's cautious August strategy paid dividends in September. The company witnessed robust growth in customer retails during the first nine days of Navratri, with SUVs growing over 60% and commercial vehicles by over 70% compared to the same festive period last year. The surge in festive demand placed significant constraints on trailer availability, with Mahindra scrambling to improve dispatches to its dealer network.

Across Segments

For Tata Motors, the September surge was broad-based across its portfolio. The Nexon delivered a record-breaking performance with over 22,500 units sold in a single month - the highest-ever sales for any Tata Motors passenger vehicle. This compact SUV, perfectly positioned to benefit from the GST cuts, saw unprecedented demand as its effective price dropped significantly.

The Harrier and Safari SUVs achieved their best-ever combined sales, fueled by the newly launched Adventure X edition and multiple powertrain options. The Punch continued to expand its widespread appeal, further cementing its status as the popular choice among customers in the compact SUV segment.

The company's electric vehicle strategy proved particularly successful, with quarterly EV sales surging 59% year-on-year to nearly 25,000 units in Q2 FY26, recording Tata's highest-ever EV performance and contributing a record 17% to overall sales. September alone saw EV sales surge over 96% year-on-year to 9,191 units, while CNG sales reached an all-time high of over 17,800 units, reflecting a remarkable 105% growth compared to Q2FY25.

The August slowdown was particularly notable because it occurred despite favorable timing. The festival season – including both Onam and Ganesh Chaturthi – began in late August, about 10 days earlier than in 2024. Under normal circumstances, this convergence of festivals typically drives 15-20% higher sales, but the festival demand was completely overwhelmed by GST speculation.

The impact was felt across all major manufacturers. Maruti Suzuki's domestic PV sales had tumbled 8.2% to 131,278 units in August. Mahindra's August sales dropped to just 39,399 SUVs. Even the commercial vehicle segment, typically less affected by consumer sentiment, saw manufacturers pulling back on dispatches to protect dealer inventories.

Dealers reported a frustrating August, with showrooms seeing healthy footfalls but minimal conversions. Many customers who visited dealerships explicitly stated they were waiting for the GST announcement before making their purchase decision. Some even cancelled existing bookings, preferring to wait for the potential savings.

GST 2.0: The Game Changer

The GST reforms that took effect on September 22, 2025, represented the most significant overhaul of India's indirect tax system since the original GST implementation in 2017. The new structure simplified the earlier four-slab system (5%, 12%, 18%, 28%) into primarily two slabs of 5% and 18%, with a special 40% rate for luxury and sin goods.

For the automotive sector, the benefits were immediate and substantial. Small cars with petrol engines up to 1,200cc and diesel engines up to 1,500cc (both under 4 meters in length) saw their tax burden drop from 28% to 18%. This 10 percentage point reduction translated to savings of ₹50,000 to ₹150,000 depending on the vehicle's price, making cars suddenly affordable for a much larger segment of middle-class buyers.

Commercial vehicles, including buses, trucks, and three-wheelers, also benefited from the rationalized 18% rate, providing relief to the logistics and transportation sectors.

Despite the August hiccup, both Tata Motors and Mahindra demonstrated remarkable resilience in their Q2 FY26 performance. Tata delivered total sales of 144,397 passenger vehicles, registering a robust 10% year-on-year growth. Mahindra sold 145,503 passenger vehicles in Q2 FY26, up 7% year-on-year over Q2 FY25's 135,962 units.

The quarter also saw Tata's strategic expansion into international markets bear fruit, with exports to South Africa growing 5x compared to the previous year. Mahindra's exports contributed 4,320 units in September 2025, registering a 43% year-on-year growth.

Shailesh Chandra, Managing Director of Tata Motors Passenger Vehicles Ltd., noted that customer interest remained exceptionally strong, with new bookings doubling in the latter half of September following the GST rate reduction. "With a strong booking pipeline, agile supply readiness, and rising demand driven by festive cheer and accessible pricing, we are well-positioned to carry this growth momentum in H2 FY26," he stated.

Commercial Vehicles Join the Party

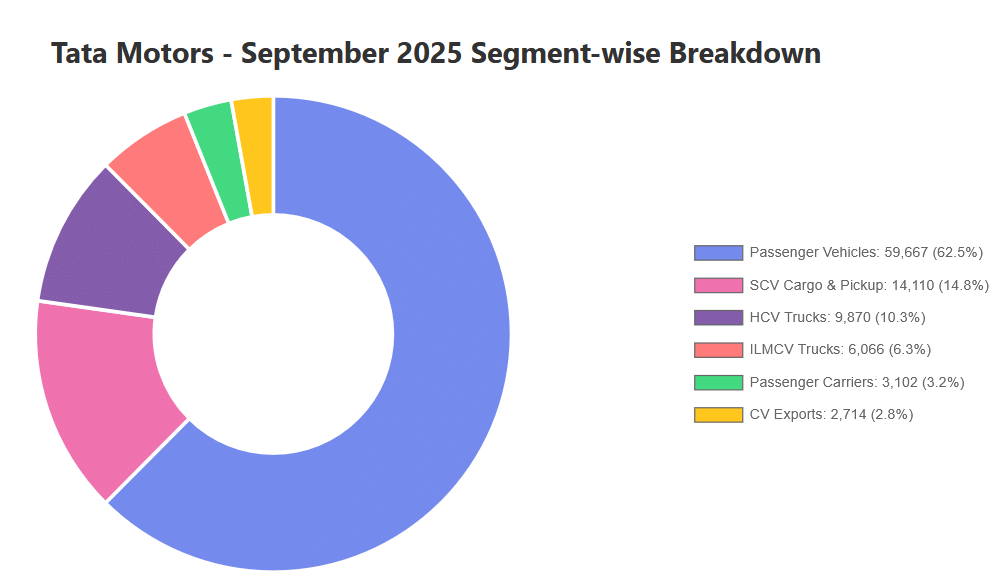

The commercial vehicle segment also benefited from the GST reforms and improving economic conditions. Tata Motors' commercial vehicles delivered Q2 FY26 sales of 94,681 units, registering a 12% growth over the same period last year. September saw particularly strong performance in the SCV and pickup segment, which grew 30% year-on-year, driven by new launches like the Ace Pro and Ace Gold+.

Girish Wagh, Executive Director of Tata Motors Ltd., highlighted that September was the company's best-performing sales month in FY26 for commercial vehicles, with the GST reduction announcement prompting swift action to enhance product availability and sharpen pricing strategies.

Festive Relief for Hyundai, Maruti

Maruti Suzuki, still commanding roughly half of India's passenger vehicle market, achieved its best single-day performance in 35 years on September 22, delivering close to 30,000 vehicles after receiving more than 80,000 enquiries. Bookings for its small-car segment - the biggest beneficiary of the GST cuts - rose by 50% compared to typical festive trends, with dealerships extending hours to accommodate the unprecedented customer demand. Hyundai Motor India also posted its strongest single-day sales in five years, with around 11,000 dealer billings, reflecting the combined boost of festive sentiment and reduced vehicle prices under GST 2.0. The Korean automaker's recovery was particularly notable given it had suffered the sharpest decline among major manufacturers in August, with sales dropping 11.2% year-on-year to 44,001 units.

The September sales explosion appears to be more than just a one-month phenomenon. Industry data from the first nine days of Navratri showed passenger vehicle and two-wheeler sales jumping over 20% compared to the same period last year, though overall festive season registrations from Ganesh Chaturthi to September-end remained somewhat muted as many consumers had already made their purchases immediately after the GST announcement.

With the festive season in full swing, improving consumption patterns, and the full impact of GST reforms yet to unfold, industry experts anticipate sustained strong performance through the remainder of FY26. Construction, infrastructure, and mining activities are expected to gain momentum, further fueling demand for both passenger and commercial vehicles.

The psychological impact of "government-driven discounts" through GST reduction, combined with genuine price benefits, has created a powerful catalyst for demand. For middle-class families who had been deferring purchases, the combination of lower prices and festive sentiment has proven irresistible.

As India's automotive industry emerges from the GST transition, September 2025 will be remembered as the month when speculation gave way to celebration, and patience was rewarded with record-breaking sales across the board. For Tata Motors, achieving its highest-ever monthly sales while competing neck-and-neck with Mahindra's own record-breaking performance underscores the depth of demand that GST 2.0 has unlocked in the Indian market.

RELATED ARTICLES

TVS Apache Rules 150-200cc Segment, Set for Record Sales of 550,000 in FY2026

With 382,431 units sold in the first 8 months of FY2026 and 24% growth, TVS Motor’s best-selling motorcycle not only com...

Maruti Fronx First Nexa SUV to Drive Past 400,000 Sales

Maruti Suzuki’s Fronx has crossed 400,000 domestic wholesales in 32 months and leads Nexa’s FY2026 lineup with 108,866 u...

River Mobility Clocks Best-Ever Monthly Sales in November: 1,801 Indie E-Scooters

Bengaluru’s River Mobility, maker of the Indie e-scooter that inspired Yamaha’s EC-06, crosses 1,800 monthly sales and 1...

By Arunima Pal

By Arunima Pal

01 Oct 2025

01 Oct 2025

7402 Views

7402 Views

Ajit Dalvi

Ajit Dalvi